Home > Information > Car

#Car ·2024-08-15

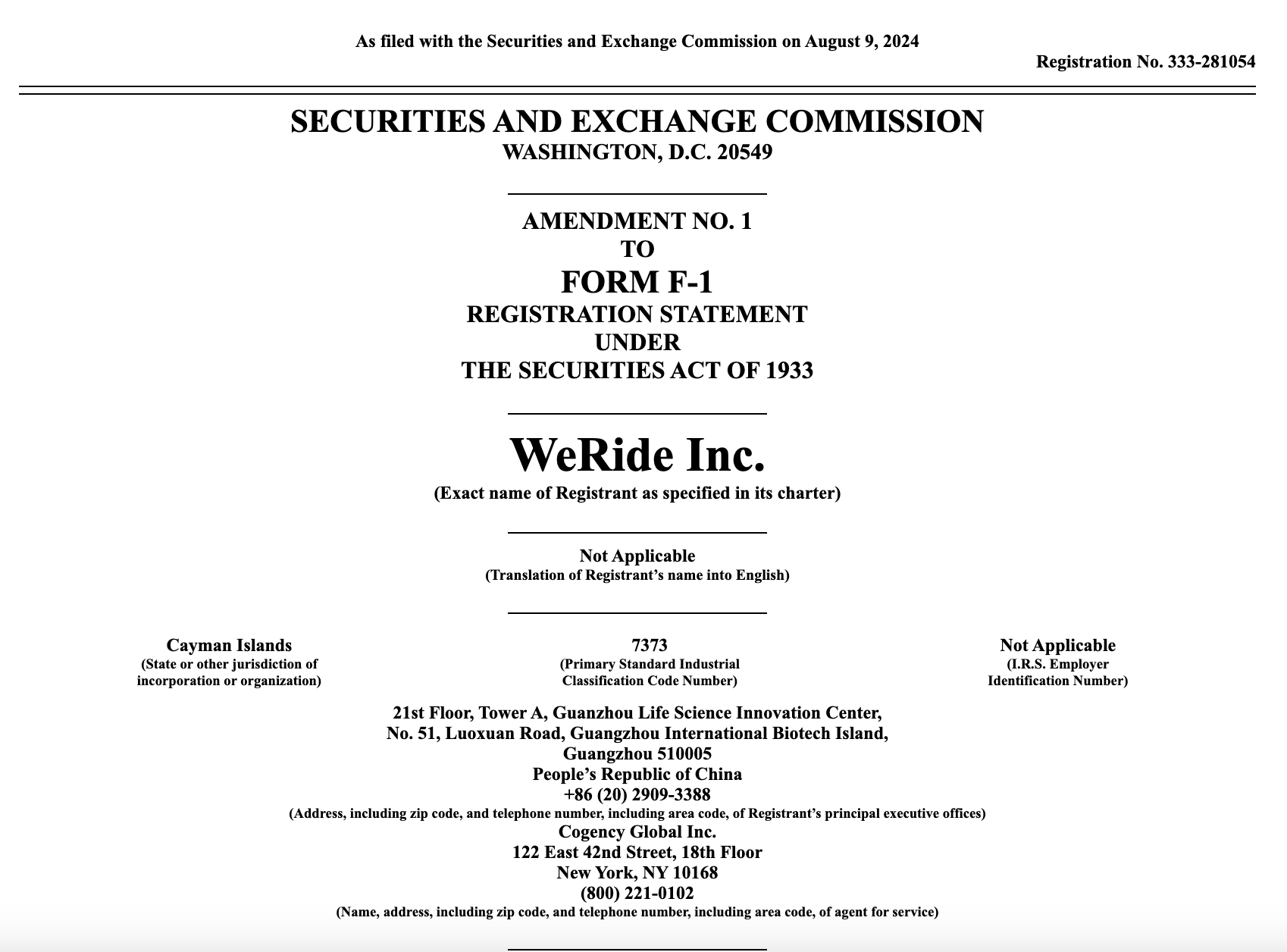

Recently, according to Bloomberg and Reuters, Chinese self-driving car company WeRide is officially preparing to go public in the United States. The company hopes to achieve a valuation of up to $5.02 billion in an initial public offering under the ticker symbol "WRD."

Morgan Stanley, jpmorgan Chase & Co. and China International Capital Corp. are the lead underwriters for the IPO.

The company will issue 6.45 million American Depositary shares (ADSs) at an issue price of $15.50 to $18.50 each, with each ADSs representing three ordinary shares.

According to public information, Wenyuan began operations in 2017, dedicated to the research and development of autonomous driving technology, and has now been tested or commercially deployed in 30 cities in seven countries, and has one of the largest autonomous driving fleets in the world. At present, the company is not only committed to the research and development and application of L4 level autonomous driving technology, but also through its core platform WeRide One to create L2 and L4 level autonomous driving technology, covering passenger cars, robotaxis, unmanned minibuses, autonomous vans and unmanned sweepers and other fields.

Assuming an IPO price of $17 per ADSs, Wenyuan expects the offering to raise approximately $96 million, or $111.3 million if the underwriters exercise their overallotment option in full. The company is offering 6.45m ADSs at a price range of $15.50 to $18.50 each, so the IPO could raise as much as $119.4m.

In addition, a group of investors have agreed to purchase $320.5 million worth of shares in a concurrent private placement. For example, Alliance Ventures, the venture capital arm of the Renault-Nissan-Mitsubishi Alliance, has agreed to buy $97 million worth of shares. Other investors include JSC International Investment Fund, Get Ride and others, according to regulatory filings.

Earlier, Bloomberg, citing people familiar with the matter, reported that Wen Yuan Zhixing would seek more than $400 million in an IPO and private placement. Of that, about $100 million will come from the IPO and about $200 million to $300 million will come from the private placement.

WeRide was not immediately available for comment.

Screengrab of a filing with the U.S. Securities and Exchange Commission by Wen Yuan Zhiyuki on August 9, 2024.

Complete file address: https://www.sec.gov/Archives/edgar/data/1867729/000119312524197868/d343706df1a.htm#rom343706_5

It is reported that Wen Yuan Zhixing, formerly known as Jingchi Technology, was founded in 2017, and its co-founder and CEO is Han Xu, the former chief scientist of Baidu's autonomous driving division. Prior to joining us, Han Xu was an assistant professor, a doctoral supervisor and director of the Computer Vision and Machine Learning Laboratory at the University of Missouri, .

Yan Li, , co-founder and CTO of Wen Yuan Zhixin, has a Ph.D. in Electrical and Computer Engineering from Carnegie Mellon University . Yan has worked as a core engineer at Facebook and Microsoft, and was an early employee of Microsoft Research Asia. is also a top expert in the field of computer vision in China.

In addition, Shen Xiangyang, former Microsoft global executive vice president and a well-known AI bull, was an early investor in the company.

Since its establishment, has been focusing on the research and development and application of autonomous driving technology, and is a technology-driven enterprise. According to statistics, as of June 30, 2024, Wenyuan Zhixing's more than 2,000 employees, the proportion of research and development personnel accounted for 91%.

On the product side, the company already has licenses to operate autonomous vehicles in China, the United Arab Emirates and Singapore, as well as licenses to conduct human and driverless testing in California, and is actively testing in SAN Jose. In addition to publicly operating self-driving taxis, Wenyuan is also developing driverless buses, driverless vans (for delivering goods) and driverless sweepers. The company also offers advanced driver assistance systems and plans to sell them to Oems.

In the commercialization process, the company's two main sources of revenue: one is the sale of L4 level autonomous vehicles, including various robotic vehicles and sensor kits; The second is to provide L4 autonomous driving and Advanced Driver assistance system (ADAS) services, covering a full range of services such as operations, technical support and ADAS research and development.

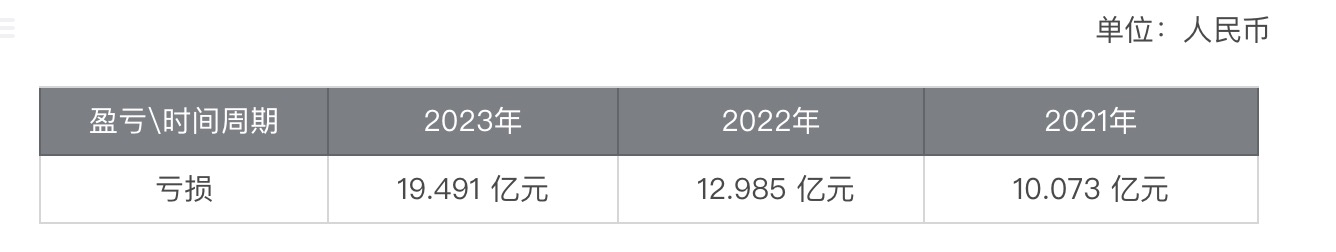

But because autonomous driving technology requires huge investment in research and development, Wenyuan is still at a huge loss. In a filing with the US Securities and Exchange Commission, Wen Yuan Zhixin's annual losses in 2021, 2022 and 2023 were 1,087.3 million yuan, 1,298.5 million yuan and 1,949.1 million yuan, respectively. For the six months ended 30 June 2023 and 30 June 2024, the Company's loss was RMB723.1 million and RMB881.7 million (US $121.3 million), respectively.

For 2021, 2022 and 2023, the company's non-international financial reported adjusted net losses were RMB426.8 million, RMB401.7 million and RMB501.7 million (US $69 million), respectively. The six months ended June 30, 2023 and 2024 were RMB231.5 million and RMB316.1 million (US $43.5 million), respectively.

In addition, the prospectus data shows that between 2021 and 2023, Wenyuan Zhihong's autonomous taxi sold a total of less than 20 units, of which 5 units were sold in 2021, 11 units were sold in 2022, and only 3 units were sold in 2023. The sales of driverless minibuses were 38, 90 and 19 units respectively in three years.

According to Wenyuan's prospectus, the company plans to spend 35% of the IPO proceeds on research and development; 30% for the commercialization and operation of autonomous vehicle fleets and marketing activities to expand into new markets; 25% for capital expenditures such as the purchase of test vehicles; The remaining 10% is for general corporate purposes.

If successful, it would be the largest U.S. IPO by a Chinese company since Zeekr, a luxury electric car startup owned by Geely, listed on the New York Stock Exchange in May. It is worth noting that since its debut, Zeekr's share price has fallen by 48%.

Wenyuan initially filed confidentially for a U.S. listing in March 2023. The self-driving car company has raised a total of $1.39 billion and is valued at $5.11 billion, according to PitchBook. But Wenyuan hasn't raised a private funding round since 2022, and venture capital firms are no longer writing big checks to self-driving car companies that have a long road to profitability. If it wants to expand and remain competitive, it needs access to the public markets.

Wenyuanzhixing is not the only Chinese self-driving car company hoping to try its luck in the U.S. market. One of Wenyuan Zhixing's main competitors, Pony Zhixing, is also reportedly preparing to go public in the United States again, after its previous efforts failed in 2021. Pony Wisdom had planned to IPO through the SPAC merger at a valuation of $12 billion, but it has not been approved, so the pace of listing has been postponed.

Previously, Jiemian News quoted people familiar with the matter as saying that Chinese autonomous driving startup Pony Zhixing is expected to IPO in the United States as early as September.

Pony Wisdom is reportedly backed by Toyota and NiO Capital, and has received clear investment interest from several institutional investors. For Pony Wisdom, the challenge of its U.S. IPO is not the process itself, but how to find a valuation that balances the psychological expectations of the founding team, early investors, and secondary market investors.

Founded in late 2016, Pony Wisdom has research and development centers in Silicon Valley, Guangzhou, Beijing and Shanghai, and has local autonomous taxi operations.

Before pony wisdom, after Wen Yuan Zhixing, why do these domestic autonomous driving companies flock to the United States IPO? What benefits will the IPO bring to these companies?

Cosset, an investment manager of a domestic AI investment institution, told the AI front that the biggest reason for these companies to IPO in the United States is to get more capital support. The development and application of autonomous driving technology requires a large amount of financial support. Ipos in the United States can provide these companies with broader financing channels to meet their rapidly developing capital needs. For example, Pony Wisdom has completed several rounds of financing before the IPO, but it still needs more funds to promote the commercialization of technology and market expansion.

In addition, the US capital market has a high degree of recognition for high-tech enterprises and innovative enterprises, and it can be seen from the financing process of many foreign autonomous driving companies that they favor autonomous driving technology. On the other hand, frankly speaking, the regulatory and legal environment of the US capital market is relatively mature, which is more conducive to protecting the interests of investors.

As for the post-IPO proceeds, Cosset said most will be "fame and fortune." An IPO in the U.S. means they are going global, which helps them raise their international profile and expand overseas. For autonomous driving companies, the expansion of the international market is an important direction for its long-term development. Of course, there are some challenges, such as as a domestic company, how can they gain recognition in the international market? How can they more clearly communicate their core innovation and commercial landing plan? These are problems that need to be solved slowly.

At present, automatic driving has gone through the stage of technical verification and product creation, and officially entered the second half. In the second half, a core direction is commercialization.

It is also an indisputable fact that the commercialization of autonomous driving is difficult to land. Previously, experts in the field of automatic driving said in an interview with the AI front that the most typical restriction on the commercial landing speed of automatic driving is the cost of hardware, the reliability and safety of proven high-complexity software systems, and how to select and land complex scenarios. In addition, in terms of laws, regulations and society, there are also problems related to the identification of responsibility for automatic driving.

However, the autonomous driving "battlefield" is crowded, and the giants are also exploring their own business paths to find more possibilities.

Robotaxi is the most valuable business model of autonomous driving, and at this stage, many autonomous driving technology companies are trying to Robotaxi. In 2024, many autonomous vehicles will move from closed road test sites to real roads. Baidu, Pony Wisdom, Wenyuan Zhixing, and other enterprises have realized demonstration operations for the public and accelerated the commercialization process.

In addition, the self-driving truck track is also particularly hot, mass production and commercialization are accelerating, and the head player is moving to the market. At this stage, RoboTruck is similar to the passenger car from assisted driving to driverless progressive development route. From the perspective of development, Robotruck has the feasibility of commercial closed-loop, but the mass production of autonomous driving system will be a hurdle.

Reference link:

2025-02-13

2025-02-13

2024-12-16

13004184443

Room 607, 6th Floor, Building 9, Hongjing Xinhuiyuan, Qingpu District, Shanghai

gcfai@dongfangyuzhe.com

WeChat official account

friend link

13004184443

立即获取方案或咨询

top