Home > Information > Financing

#Financing ·2025-02-08

Cailiannews February 8 (Editor Yang Bin) After experiencing hot at the end of last year, the issuance and trading of the ABS market cooled at the beginning of the year. In January, the scale of ABS issuance fell by 48% month-on-month, and the trading volume fell by 33.6% month-on-month. The supply of ABS recovered last year, and under the false start market at the end of the year, the scale of new securities held by funds increased from the previous quarter. Institutions expect that bank self-management and bank wealth management will support the demand side of ABS this year.

The scale of ABS issuance fell sharply in January, and the scale of credit ABS issuance fell significantly

According to Wind data statistics, according to the project foundation date, in January 2025, a total of 165 types of ABS were issued, with a total of 136.351 billion yuan, down 48% from the previous month. Credit ABS issued only 2.73 billion yuan in January, down 96 percent from the previous month. From the perspective of the underlying asset type, the bank/Internet consumer loan ABS that rose last year still issued 16.490 billion yuan in January, which increased from the previous month and was less affected by seasonal disturbance.

Industrial research pointed out that after the end of the year-end financing demand, ABS seasonal supply repair ended. At the registration level, the scale of newly registered products on the Shanghai and Shenzhen exchanges in December 2024 decreased significantly from the previous month. New Year project reserves still need time, ABS supply is affected by seasonal disturbance, ABS supply decreased in January.

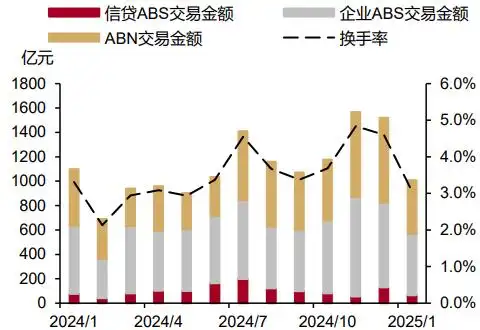

At the same time as the decline in issuance, the turnover activity of the ABS secondary market also cooled in January. According to the statistics of Zhang Wei, chief of China Merchants Securities fixed income, the monthly ABS trading volume in January was 100.943 billion yuan, down 33.6% from 152.045 billion yuan in December 2024. The monthly turnover rate of ABS was 3.1 per cent in January, down 1.5 percentage points from 4.6 per cent in December.

At the same time as the supply of ABS at the end of last year, ABS transactions were also very hot, and the turnover and turnover rate in the last two months of 2024 were the highest in the year.

Cicc's research team pointed out in the analysis of the recent four seasons of fund holdings that under the supply improvement and the year-end running market, the scale of fund holdings of new bonds increased from the previous quarter. In the fourth quarter of 2024, ABS intensive issuance, the yield continued to decline, and the fund increased its holding of new bonds in the quarter by 5.78 billion yuan, an increase of 34% from the previous quarter. At the end of the year, table products are an important direction to increase holdings, mainly in specific non-gold debt, non-performing loans, real estate supply chain and accounts receivable.

In terms of ABS investors, the statistics of China Merchants Solid Income show that commercial banks hold the most positions in credit ABS, accounting for 72%; In terms of corporate ABS, trust institutions and banks are the main investors of corporate ABS of SSE, while general institutions and trust institutions are the main investors of corporate ABS of SSE. ABN holds the most non-corporate products, accounting for 60%.

Where will the future demand for ABS come from?

Huatai Securities fixed income team believes that bank self-management and bank financing have support for ABS demand side. The new capital regulations reduce the ABS capital occupation and further improve the willingness of banks to allocate high-grade ABS. In terms of financial management, the non-standard contraction in the past two years is difficult to reverse, the interest rate of bond varieties, the manual cancellation of channel deposits and deposits, and the self-regulatory mechanism to reduce the interest rate of enterprise agreement deposit have led to a lack of assets in financial management, and bank financial management or additional ABS under the pressure of institutional underallocation.

In terms of yield, in January, affected by factors such as funds, the short end of the bond market adjusted significantly, while the yield to maturity of medium and short term ABS also mostly rose, and the yield to maturity of 10-year ABS continued to decline.

According to the statistics of CMDR, the yield to maturity of AAA-rated asset-backed securities with 1 year, 3 years, 5 years and 10 years are 1.88%, 1.75%, 1.90% and 1.99%, respectively, with changes of 12.5bp, 4.9bp, 0.1bp and -12.0bp compared with the end of 2024. However, due to the smaller adjustment, the spread between ABS maturity yield and short - and medium-term bills in January mostly fell to negative.

According to the analysis of Huatai Securities fixed income research team, ABS liquidity is weak, liquidity compensation exists, and valuation adjustment lags behind credit debt. In the market adjustment, the premium of ABS varieties tends to narrow, reflecting a certain resistance.

At present, short term ABS is more cost-effective. Xu Xi, a fixed income researcher at Sinofold Securities, believes that the duration of consumer finance ABS is generally short, the debt rating is higher, there is a certain yield advantage, and it has a high cost performance for short duration allocation.

2025-02-10

2025-02-08

2025-02-08

13004184443

Room 607, 6th Floor, Building 9, Hongjing Xinhuiyuan, Qingpu District, Shanghai

gcfai@dongfangyuzhe.com

WeChat official account

friend link

13004184443

立即获取方案或咨询

top